What is the double whammy in Italian tax?

The “double whammy” is what hits new businesses in the second year after start-up.

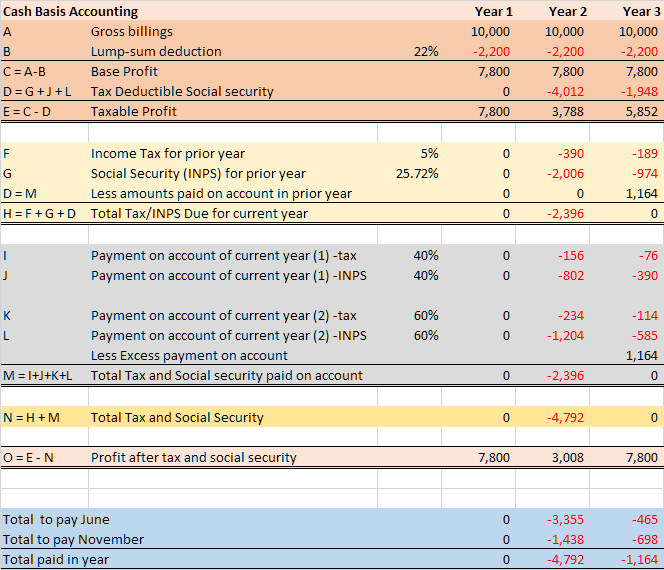

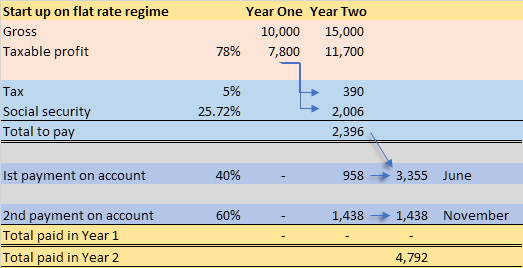

No tax in your first year

You pay no tax in your first year of operations but the tax due for that first year is due at the end of June of the following year. Tax is still due on your earnings (the tax “accrues” in accounting parlance), but you don’t need to hand it over to the Italian tax/social security authorities until June of the following year. By “year” we mean calendar year. So, if you start up in business on 1 March 2019, you won’t have to pay any tax until the end of June 2020.

The Double Whammy hits in your second year

But (and this is the double whammy) at the same time, you must start to make payments on account of the current year. The first payment on account is equal to 40% of the tax payable on the prior year’s income. A second payment on account is due at the end of November – 60% of the prior year’s liability. So in year two, you can be paying two years of tax at the same time – the double whammy.

Of course you have had the benefit of the first year, with no tax. And in year three you have the benefit of the payments you made on account in year one. These payments on account made in year two reduce the tax (and social security (INPS)) payments to be made in year three. So in that third year, you will only have to pay the top-up tax on year two, if you have earned more profit than in year one, along with, of course, the payments on account of the tax due for the current year. But the second year can be difficult as a result of the double whammy. And with the November payment you are effectively lending the Italian exchequer the tax due for the last month of the year.

Social Security Too

Social security generally follows a similar logic. The self employed make their payments of social security contributions to INPS at the same as they pay their tax.

Important note to self – put your future tax liabilities to one side as you earn your money

Many people manage to start a business and then find this out as a surprise. Clients should open up a separate (from their personal account) bank account for their “business” and keep a balance in it sufficient to cover their future tax (including VAT if they are so registered) and social security liabilities – these are fiddly to forecast. As a rough guide someone on the regime forfettario should set aside 25% of amounts received from clients, in the first year, and 20% thereafter. The situation is even more complicated because your INPS payments become deductible in computing the taxable base on which the tax and INPS contributions are calculated in the year in which you pay them. So last year’s tax and INPS payment reduced your taxable base. In the third year, by reason of the double whammy you have a lower tax base. Depending on how fast your earnings increase, you overpay tax/INPS in the double whammy year and have an excess credit due to the deduction of two years tax and contributions in one year.

Most people don’t need to worry: they can let their commercialista, CAF, or us, deal with the calculations. Just remember to set aside 25%/20% of whatever you receive from clients.

Reducing Tax/INPS payments on account

You can reduce (at your own risk) the amount you pay on account if you think you are going to earn less this year compared to last year. If the total of payments made at 30 November turn out to be less than 100% of the amount due then steep penalties are payable if you are assessed by the tax office. If you self-disclose the shortfall and top-up before you are assessed by the office you pay only a small late-payment penalty.

The payments on account are based on the taxable income shown in the income tax return (Modello Reddito PF) at Line RN 34 (or possibly at Line RN61 in certain cases)

If the payment on account is less than Euro 51,65 no account payment is due.

If the amount due exceeds Euro 52,00 but is less than Euro 257,52 you only need to make a single account payment by the end of November.

No account payment is due for the additional regional regional income tax.

The payment on account of the municipal surtax is 30% of Line RV 17.

Leave a Reply