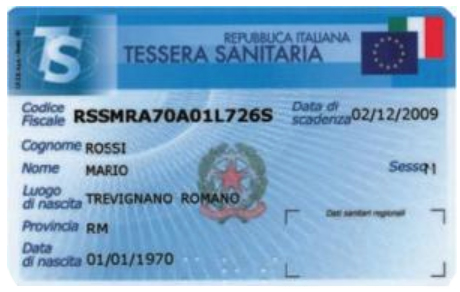

The Fiscal Code Number (Codice Fiscale, Italian taxpayers’ identification number, TIN, tax code, call it what you like) is a unique taxpayer code that identifies all individuals in their dealings with the Italian authorities and is a mandatory requirement for a whole series of activities.

Every Italian baby gets a Codice Fiscale at birth, while foreigners have to apply to the Italian Tax Agency (Agenzia delle Entrate).

When Is a Codice Fiscale Needed?

The Codice Fiscale is required to:

• Open a bank account

• Sign an employment contract

• Work as a freelancer

• Sign utility contracts

• File tax returns, pay tax and get refunds

• Access the health system

• Purchase sell and rent properties

• Purchase motor vehicles

• Enter into HP/Finance Leasing contracts

There are other many other activities that require the Codice Fiscale.

How is the code determined?

For individuals the code consists of consists of 16 alphanumeric characters. The regulations governing the method of calculating the tax code is contained in a decree of the Ministry of Finance dated 23 December 1976.

There are several web-sites that can generate your tax code for you but the law provides that the only valid fiscal code is the one that is issued by the Tax Agency.

Under no circumsntaces should you use a fiscal code number generated by one of these pages. if you have not been formally issued a fiscal code number the use of a number generated by a website could be deeemed fraudulent.

An algorithm is used to calculate the tax code and works as follows:

Surname (three letters): The consonants of your surname are taken in their order (last name first, followed by the first name then second and so on). If there are not enough consonants, a vowel or vowel can be used, again in the order in which they appear and after the consonants. If a name has fewer than three letters, the code part is completed by adding the letter X;

Name (three letters): the consonants of your first name (or names, if there is more than one) in their order (first name, followed by the second and so on) with similar rules as with the surname;

Date of birth and gender: (five alphanumeric characters);

Birth Year (two digits): take the last two digits of the year of birth;

Month of birth (a letter): each month of the year is associated with a letter according to a table;

Day of birth and gender (two digits): the two digits of your birth day (if between 1 and 9 a zero is added as the first digit). For females the number 40 is added. In this way, the field contains both the date of birth and gender;

Municipality (or Country) of birth (four alphanumeric characters): taking from a standard table of municipality (Comune) and foreign country codes;

Final Control Number: From these fifteen alphanumeric characters a final control number is arrived at based on a special algorithm.

How to get a Code

You can make an appointment to your local tax office tax office (Agenzia delle Entrate) with your ID documents, the completed form(s) and request a code. Normally it will be assigned immediately and without cost. The process is usually all in the Italian language. If you live abroad you can apply to your local Italian Consulate, and if you are initiating immigration proceedings they Consulate will assign the fiscal code number as part of the procedure.

Timescales can be variable depending on workload in the local office or Consulate ranging from a few days to a few months.

It is possible to obtain a fiscal code number remotely and we have teamed up with IL Law Firm to be able to offer this service to those who wish to receive their fiscal code number rapidly from your desktop or mobile phone. Click below to start the procedure.

How to check a Fiscal Code Number

The Italian Tax agency has a webpage where you can check if the fiscal code number you enter corresponds to a valid in the Tax Agency. at present there is no lookup facility – so you cannot insert someone’s name and details to find their fiscal code number – it only tells you if a code number is valid or not, and not who it belongs too.

I do not live in Italy, I am not registered there, I do not own property in Italy nor do I have any income there. Due to family reasons, I am requested to apply for n Italian fiscal code. If I do, what liability can follow? Would I have to file taxes in Italy for income and property I have elsewhere? Would Italy tax me?

Your liability to tax in Italy depends on a series of factors none of which involve whether you have a fiscal code number or note. The factors I’m talking about are tax residence, source of the income, location of assets, type of income, type of tax, etc etc. These rules are complex, but I cannot think of any example where the fiscal code number is relevant in the analysis. If you do not have any liability to Italian tax you do not need to file a return, so simply having a fiscal code number in itself will not require you to file a return.

Of course having a fiscal code raises the holders “visibility” but this should be of concern only to those seeking to stay below the radar to evade tax liabilities which exist anyway due to the rules I mentioned above.

Hi sir! Hope you well fine .my name is Muhammad shoaib now live in Pakistan is a refugees but basically I am afghan ,now I am going to apply for scholarship but they want fiscal code so how I can fine it? Thans

I want to know about tax code for university of venice application payment fee. I am not getting how to generate that code. Please let me know as soon as possible then I proceed with the payment of application fee.

On the website for the Italian Tax Agency you gave what does this search do (second search on left) “Verifica e corrispondenza tra il codice fiscale e i dati anagrafici di una persona fisica”

Does this confirm that tax returns have been lodged for the fiscal code that you enter if it generates a “valid data” result

It just confirms that the fiscal code you entered corresponds to a real tax code issued by the Italian Tax Agency. It does not give any information regarding the status of the holder’s filings.

I am a foreigner and assigned to work in Italy. Do I need to cancel my fiscal code when my assignment is cancelled

Hi Cloe, you do not need to cancel your fiscal code number and indeed I do not think there is any method so to do, for an individual, except in cases of error. It is simply a code number and remains with you for life. If you return to Italy at any time or have any dealings in Italy in future then your code will simply be there. So do not lose it, you never know. If, for any reason whatever you change name (e.g marriage) before you need the fiscal code number in future, you should advise the Tax Agency so that they can issue a new fiscal code and cancel the old one. It might be possible to advise the Tax Agency of a change of address using the same form used to apply for the fiscal code number but the preferred specific procedure is outlined below.

What is very important is that you cancel your registration as resident with the anagrafe maintained by your Comune and hand in, or destroy your ID card. Some Comune allow you to notify the change this by registered electronic mail (PEC) or online. If you do not remove yourself from the register of resident population, you might be presumed to remain tax resident in Italy, under the Italian test of tax residence for the rest of time!

You should also consider, especially if you are not an Italian citizen, advising the Italian Tax Agency of an address for service of official notices (e.g. assessments or tax enquiries). And if you think that making yourself hard to find is a good idea to escape tax assessments, think again. There is a procedure whereby the authorities can file a notice e.g. of assessment or payment demand, with the Comune where you were formerly resident. After a period of time, the notice will be automatically deemed to have been validly served. Once the timescale for response, appeal, initiation of a negotiated settlement have lapsed, the authorities will be entitled to commence enforcement proceedings. Having lost the right to challenge the assessment, the amounts due are final – you will have missed the boat for presenting a challenge..

The procedure and form for reporting the transfer of residence to the Tax Agency can be found here.

Let us know if you need any assistance.

Thanks for the article! This knowledge of the Italian fiscal code number will be helpful for my own accounting solutions UK business.