What are they?

It is important to note that each tax relief has specific eligibility criteria, timings, deadlines and requirements, so consultation on any specific works with a professional (in the first instance a Geometra or Architetto) is essential in order to determine which tax relief is applicable to your specific situation, depending on works done or to be done. The legislation, guidance, deadlines, and requirements/procedures to secure any tax relief have been and continue to be constantly updated.

Tax Credit for renovation/refurbishment work

This consisted originally of a tax deduction – a reduction in computing personal income tax (IRPEF) of 36% (ie. a tax credit) of the expenses incurred, up to a total amount originally not exceeding Euro 48,000 per property unit, now increased to Euro 96,000.

The tax credit must be taken in 10 equal annual instalments.

This tax relief is available nationwide.

The tax relief is due to end at the end of FY 2024. However it has seen earlier termination dates over the years and been extended in the past, so there remains a possibility that it will be extended after the end of this year, albeit with different conditions and benefits..

What kind of work qualifies for the relief

The work on individual building units qualifies for the tax relief if it falls within the list of contained in a Presidential Decree (380/2001). In summary this includes:

Extraordinary/ Special maintenance

“Manutenzione straordinaria” is a relatively well defined in Italian law. It consists of works intended to to renovate and replace parts of a building, including the structure, and to implement and supplement health, safety and technological services. They must not change the overall volume (cubic metres) of the building and must not result in a change of use.

Extraordinary maintenance works also include those involving a fractioning or unification of building units with execution of works, even if they involve changes in the surface area as well as the urban load, provided that overall volumetry is not affected.

Examples of extraordinary maintenance:

- installation of elevators and safety staircases

- installation and improvement to toilets and shower/bathrooms

- replacement of external fixtures and windows or shutters with shutters and with modification of material or type of fixture

- refurbishment of stairs and ramps

- interventions aimed at energy saving

- private area fencing

- construction of internal staircases.

Restoration and conservation restoration

This category includes works aimed preserving a property and ensuring its functionality by means of a set of works which, while respecting the typological, formal and structural elements allow its continued use.

Examples of restoration and conservative restoration work:

- interventions aimed at the elimination and prevention of degraded situations

- adjustment of the floor heights in compliance with existing volumes

- opening of windows for ventilation needs of the rooms.

Renovation

These are works aimed at transforming a building in a way that leads to a building that is different from the previous one in whole or in part.

Examples of building renovation:

- demolition and reconstruction with the same volume as the existing building

- facade modification

- construction of an attic or balcony

- transformation of the attic into an attic or the balcony into a veranda

- opening of new doors and windows

- construction of bathrooms and toilets expanding the existing areas and volumes.

With regard to the building renovation works eligible for the benefit of the tax deduction, the Tax Agency has made it clear, among other things, the deduction does not apply on the basis of whether the building is a “new construction”. If the renovation is carried out without demolishing the existing building and by extending the same same, the deduction is only available for expenses relating to the existing part, as the extension is a “new construction.”

Who is entitled to the relief?

The benefit is available not only to owners or holders of rights in rem over the properties on which work is carried out and who bear the costs, but also to a tenant or co-tenant.

The list of potential beneficiaries are :

- an owner or the bare owner

- a holder of a legal right (generally a registrable right in rem) to enjoyment (usufruct, right of habitation or dwelling) over land and buildings

- a tenant or the co-tenant

- members of cooperatives

- members of partnerships

- individual entrepreneurs, only for real estate that is not instrumental (ie. used as a fixed asset in a business activity) or as stock in trade.

Cohabiting family members of the owner or holder of the property in question (spouse, relatives by the third degree and relatives by the second degree) and civil partners, separated spouses, are also entitled to the deduction, provided they bear the costs and are holders of transfers and whose names appear on relevant invoices.

In these cases, without prejudice to the other conditions, the tax is available if the building consents are in the name of the owner of the property.

For those who purchase a property on which work has been carried out that benefits from the tax credit, their share of the tax credit is transferred automatically, unless otherwise agreed between the parties.

For DIY-ers ie. those who carry out the work themselves, the tax credit may be available, but only for the costs of purchasing the materials used, if properly documented and paid for, and subject to the general eligibilty rules.

Use of Tax Credit – lack of capacity

As with any tax credit you need to have taxable income which is liable to Italian tax at scale rates. So if your only income sources are taxed under, for example a flat rate tax regime (e.g. for rental income subject to the flat tax “cedolare secca”, or income from self-employment under the regime forfettario), or substitute tax regime (e.g. applicable to investment income and gains) then you most likely cannot use the tax credits. The rules that allowed the transfer of tax credits to suppliers by way of a discount on their invoices for the work or kit to be supplied, or to a financial institution willing to purchase the tax credits, have been abolished in most cases.

It remains to be seen if, when and how the possibility of transferring tax credits will be reinstated. At present outside some limited cases, this is no longer possible.

How to get the bonus

The deduction is obtained by indicating the expenses incurred in the annual tax return (Model 730 or Form PF individual tax return). There is an online procedure with ENEA to confirm the qualfying nature of the expense, and for some works an accountant’s certificate may be required.

Any tax credit not used in whole or in part can be transferred on the sale of the property. This means that, if the parties so agree, the purchaser can continue to use the remaining instalments of tax credit for the rest of the ten year period.

Documents to Keep

- certification from architect/geometra (surveyor)/director of works to the effect that the works qualify for the relief

- bank transfer receipts

- receipt of transaction (for payments by credit or debit card)

- account debit documentation (bank account statement)

- invoices for the purchase of the goods, indicating the nature, the quality and quantity of goods and services acquired.

Other tax incentives

Furniture and home appliance bonus 2023

The Italian Finance Law for 2023 (Art. 1 co. 277, Law No. 197/22) has confirmed the extension of the tax credit on the purchase of new energy efficient appliances for all of 2023. This Bonus 2023 consists of a 50 percent Irpef deduction for the purchase of furniture and household appliances of at least class A+ (A for ovens), intended to furnish a property undergoing renovation. The Furniture and Appliances Bonus falls within the renovation bonus. Tax credit available is 50 percent of the expenditure, to be calculated on a maximum amount of 8,000 euros. Comunication regarding the purchase needs to be made to the Italian Energy Authority.

Ecobonus or Superbonus 2023

This is a deduction for improving the energy performance of buildings that has two different percentages, 50% or 65%, depending on the type of work.

Works that fall under Ecobonus 2023 and are deductible at 65% are:

- Global upgrading works on existing buildings (e.g., re-roofing)

- Interventions on the building envelopes: opaque structures (e.g., insulation)

- installation of solar panels

- the replacement of air conditioning systems with class A condensing boilers and advanced thermoregulation systems

- the replacement of traditional water heaters with heat pumps

- the purchase and installation of micro-cogenerators.

Ecobonus works deductible up to 50 percent are for example:

- the replacement of windows, fixtures and solar screens

- the replacement of winter air conditioning systems with class A condensing boilers.

For works starting after the end of FY 2023 the Ecobonus is available only in limited cases.

Green Bonus 2023

Also extended to Dec. 31, 2024, is the Green Bonus for remodelling gardens and terraces. The Green Bonus 2023 provides a deduction divided into 10 equal annual installments on a maximum expenditure of 5,000 euros per property unit.

Sismabonus 2023

The Sismabonus is also extended until 31 December 31, 2024. This is a tax credit that incentivizes earthquake improvement work on buildings. It can be used in risk zones 1, 2, and 3 (which cover most of Italy). Only very few zones 4, which are considered too low a seismic risk, are excluded.

The Sismabonus 2023 also has different rates, depending on the type of property and depending on the applicable seismic risk classes.

Superbonus 2023

The Superbonus was extended to 2023, but with many changes. First, the deduction percentage drops to 90 percent for both single-family houses and condominiums, and a limit related to household income has also been introduced.

To qualify for the 2023 Superbonus, the total household income must not exceed 15 thousand euros, resulting from a specific from a specific formula. Only the owners of the housing unit can apply. Tenants and licensees will not be eligible. The home on which the work is done must be the first home (prima casa second homes no longer qualify).

Buildings containing from 2 to 4 residential housing units with a single owner or co-owned by several parties will continue to benefit from the superbonus at a rate of 110% of the notification of the commencement of works was made on or before 25 November 2022, or the relevant permit relating to demolition and reconstruction work, was applied for by December 31, 2022. In all other cases e.g. single-family, first home, non-profit etc. the tax credit drops from 110% to 90% of the relevant expenditure.

Requirement for Transparent Payment

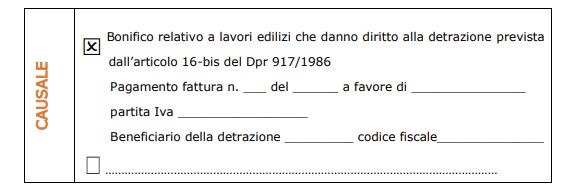

To get the tax credit payments must be made by bank transfer from an Italian bank or post office account.

The transfer must show:

the reason (causale or description) for the payment, with reference to the law (Article 16-bis of the Presidential Decree 917/1986)

fiscal code number of the recipient of the deduction

fiscal code number or VAT number of the beneficiary of the payment.

This is an example from the Tax Agency web site

Costs that cannot be paid by bank transfer (for example, building and planning consent fees, licence fees and costs, authorizations and notices of commencement of work, withholding tax on professional fees, stamp duty etc. ) may be paid in other ways – ideally by using a debit or card, or bank transfer.

Capital Gains and Superbonus

The 2024 Finance Law introduced a tightening of the capital gains tax rule where property that has been renovated using the Superbonus is sold – essentially clawing back a part of the benefit by way of tax on a future capital gain. Starting in FY 2024 the Italian government has established two measures that may lead to tax or increased tax on capital gains when real estate that has benefited from the Superbonus is sold. These specific capital gains rules do not to apply to renovation works qualifying for other tax benefits.

Generally Italian tax is not due on the sale of real estate by a private individual if the property has been owned by the seller for more than five years at the date of sale.

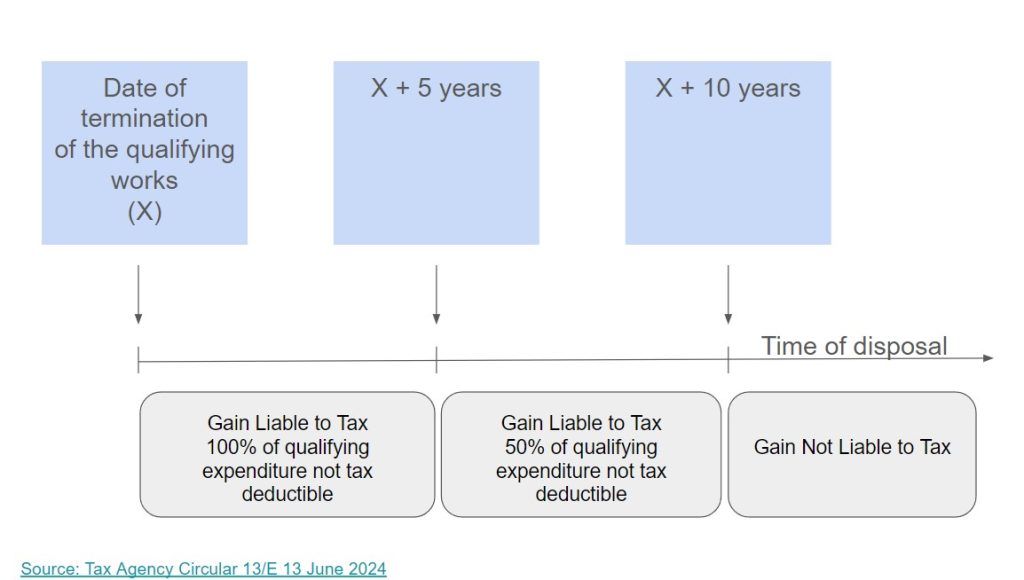

The new rules provides that for those who sell a property that has been renovated using the Superbonus, tax on any gain is due if the property has not been held for at least ten years following completion of the relevant work.

Where the benefit of the 110% Superbonus was taken the relevant renovation costs may be allowable, reducing the capital gain as follows:

- where real estate is sold within five years of the completion of the Superbonus qualifying work, the value of the renovation work is not allowable by way of reduction of any chargeable capital gain;

- where real estate is sold in the five to ten years after the works, only 50% of the value of the relevant renovation is allowable against the gain. Revaluation of certain costs may be allowable in accordance with the relevant consumer price index;

Capital gains relating to:

- real estate acquired by inheritance;

- real estate used as the transferor’s principal residence (prima casa) or that of any family member for the greater part of the ten years preceding the transfer;

- for real estate used as the transferor’s principal residence of the transferor or of any family member for the greater part of the period between the purchase or construction and the disposal, where the property has been owned for less than ten years.

are excluded from the ambit of the new rules.

Summary of Tax Liability on Capital Gains where the Superbonus has been claimed

Further reading (in Italian)

https://bonusfiscali.enea.it/ The web site of ENEA, the National Agency for New Technologies, Energy and Sustainable Economic Development, charged with handling requests for the tax credits. They have some useful lists of the qualifying expenditure under permitted/admitted interventions, other guidance and links to other web sites.

Tax Agency Circular on Capital Gains on sale of Real Estate where work qualifying for the Superbonus has been done.

Here is another overview from a tax website (with a view to publicizing their 173 page e-book on the topic) but it’s a good round up:

And another article on the “Superbonus”

https://www.fiscoetasse.com/rassegna-stampa/33309-superbonus-2024-tutte-le-novita.html

A friend of mine is working on a home renovation right now. I will share this with him. He will find it much useful than me.