What is the “Double Whammy” in Italian tax?

The “double whammy” is what hits certain individuals who have recently moved to Italy and new businesses in the second year after start-up.

No tax in your first year

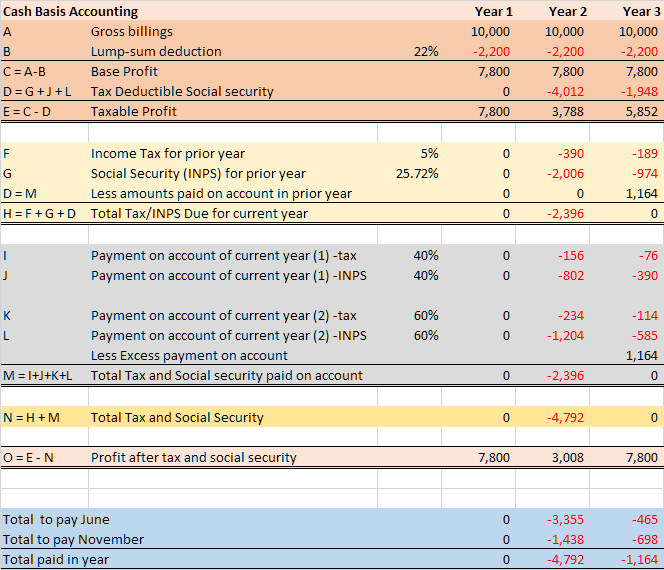

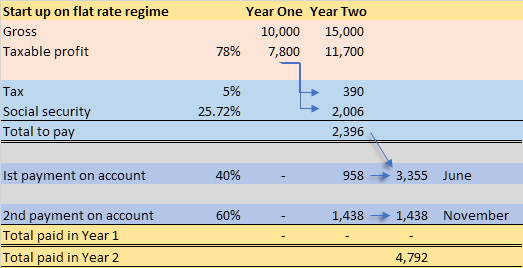

You pay no tax in your first year after the move but the tax due for that first year is due at the end of June of the following year. Tax is still due on your income (the tax “accrues” in accounting parlance during Year 1), but you don’t need to hand it over to the Italian tax/social security authorities until June of the following year. By “year” we mean the Italian tax year or calendar year for individuals and most small businesses. So, if you start up in business on 1 March 2024, you won’t have to pay any tax until the end of June 2025.

The Double Whammy hits in your second year

But (and this is the double whammy) at the same time, you must start to make payments on account of the current year. The first payment on account is equal to 40% or 50% of the tax payable on the prior year’s income. A second payment on account is due at the end of November – 50% or 60% of the prior year’s liability. So in year two, you can be paying two years of tax at the same time – the double whammy.

Of course you have had the benefit of the first year, with no tax. And in year three you will have the benefit of the payments you made on account in year one. These payments on account made in year two reduce the tax (and social security (INPS)) payments to be made in year three. So in that third year, you will only have to pay the top-up tax on year two, if you have earned more profit than in year one, along with, of course, the payments on account of the tax due for the current year. But the second year can be difficult as a result of the double whammy. And with the November payment you are effectively lending the Italian exchequer the tax due for the last month of the year.

Social Security Too

Social security generally follows a similar logic. The self employed make their payments of social security contributions to INPS at the same as they pay their tax.

The situation is even more complicated if you are carrying on business as self employed because your INPS payments become deductible in computing the taxable base on which the tax and INPS contributions are calculated in the year in which you pay them. So last year’s tax and INPS payments reduces your taxable base. In Year 1 you generally make no payment of social security contributions. Year 1 taxable profits due in Year 2 are thus not reduced by social security payments. Year 2 taxable profits will be reduced by the INPS payment made in Year 2 (on Year 1 profits) and you have a lower tax base. You can overpay tax in the double whammy year and have an excess credit due to the deduction of two years tax and contributions in one year.

Important note to self – put your future tax liabilities to one side as you earn your money

Many people manage to start a business and then find this out as a surprise. Clients should open up a separate (from their personal account) bank account for their “business” and keep a balance in it sufficient to cover their future tax (including VAT if they are so registered) and social security liabilities – these are fiddly to forecast. As a rough guide someone on the regime forfettario should set aside 25% – 30% of amounts received from clients, in the first year, and thereafter.

Most people don’t need to worry: they can let their commercialista, CAF, or us, deal with the calculations. Just remember to work out how much you need to set aside as a percentage of whatever you receive from clients.

Reducing Tax/INPS payments on account

You can reduce (at your own risk) the amount you pay on account if you think you are going to earn less this year compared to last year. If the total of payments made at 30 November turn out to be less than 100% of the amount due then steep penalties are payable if you are assessed by the tax office. If you self-disclose the shortfall and top-up before you are assessed by the office you pay a smaller late-payment penalty and late payment interest.

No account payment is due for the additional regional regional income tax.

The payment on account of the municipal surtax is 30% of Line RV 17.